Case Study

From Distress to Transformation

We help you stabilize today and build for tomorrow’s growth

Introduction

Apollo Co, a mid-sized retailer with 25 outlets, appeared profitable under traditional accounting, but deeper analysis revealed severe cash flow problems and only two months of runway left. The company approached us for strategic turnaround.

Situation

Despite reporting annual profits, Apollo struggled with severe cash flow issues due to slow collections, high upfront costs, and mounting overheads. The company’s liquidity risk became clear — it was running out of cash.

Challenge

Despite steady revenues, high overheads and unprofitable operations created a significant monthly cash bleed and a short survival runway

Solution

We developed two-part turnaround plan: first, to help the client gain a clear understanding of the company’s cash flow situation; second, to explore how the business could extend its cash runway and build strategies to bring it back to breakeven and eventually profitability

PART I

Understanding Cash Flow Situation

1Switching to

Cash Accounting

Establish a clear view of real cash inflows and outflows

2Diagnosing Reasons For The Bleed

Analyze profit and cost centres to identify financial pressure points

3Estimating Cash Runway

Assess how much time remains before cash reserves are depleted

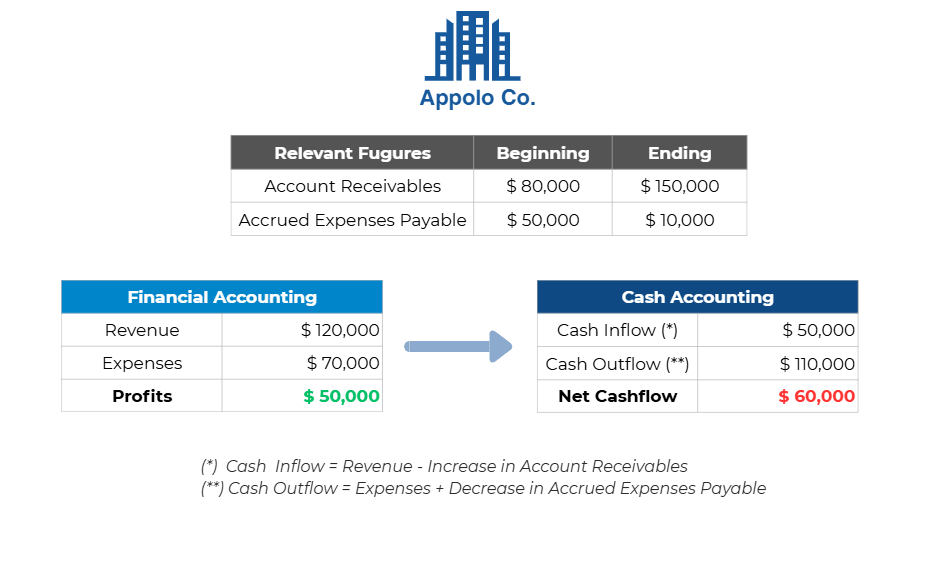

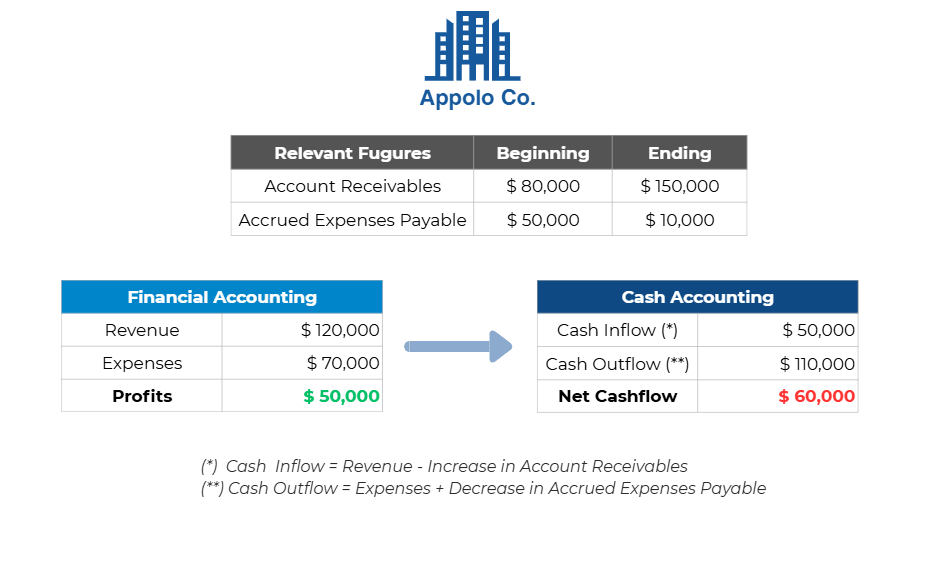

Step 1: Switching to Cash Accounting

When a business is in trouble, traditional accounting (Financial Accounting) can be misleading because it records income and expenses when they are earned or incurred, not when money actually moves. This can make the business look healthier than it really is. Cash Accounting, on the other hand, shows the real cash coming in and going out. Since cash is what keeps the company alive, this method gives a more accurate view of whether the business can survive in the short term

Step 2: Diagnosing Reasons For The Bleed

After understanding the company’s true cash position, the next step is to identify identify exactly where cash is leaking from the business. By segmenting the company into Profit Centres and Cost Centres, tracking actual cash flows, and calculating the net bleed, we create a clear picture of financial pressure points —forming the foundation for an effective turnaround strategy

Step 1

Segment the company into

Profit Centre and Cost Centre

Step 2

Switch from Financial Accounting to Cash Accounting in order to arrive the net cash inflow and cash outflow

Step 3

Sum net Cash inflow and Cash outflow to find the total bleed of the company

Step 3: Estimating Cash Runway

When your business is bleeding, the real question is: how long until the cash runs out? This period, known as the cash runway, shows how many months your company can survive before reserves are depleted.

Runway = Total Cash ÷ Monthly Bleed

Example: With S$1M in cash and a S$500k monthly bleed, your runway is only 2 months.

Knowing this number is critical — most companies fail not because recovery is impossible, but because they run out of time.

With an in-depth understanding of your cash flow situation, the next step would be to extend your runway to buy your company enough time for you to develop your turnaround strategy and get your company back to breakeven or profitability. This will be covered in Part 2 of our Turnaround Strategy Thought Leadership article, which will be uploaded in the near future.

Don’t wait until the runway runs out

Cash bleed doesn’t have to mean the end of your business. Let us help you diagnose the problem, extend your runway, and set the foundation for a successful turnaround.

LiT STRATEGY VIETNAM

+84 913 220 498

SERVICES

Business Transformation

Mergers and Acquisitions (M&A)

Turnaround Strategy

Restructuring

© 2025 LiT Strategy Vietnam, all rights reserved. Privacy Policy · Terms and Consitions